2023–24 Departmental Plan

Download the printer-friendly version (PDF)About this publication

Publication author: Canada Economic Development for Quebec Regions

Catalogue: Iu90-1/15E-PDF

ISSN: 2371-8277

Publish date: March 9, 2023

Summary: This departmental plan establishes CED's priorities and expected results for 2023-24.

Table of Contents

From the Minister

I am pleased to present to you the 2023-2024 Departmental Plan for Canada Economic Development for Quebec Regions (CED).

As a key federal partner in Quebec’s regional economic development, CED makes every effort to help SMEs and regions participate fully in a strong, sustainable, inclusive economic recovery.

Our government is convinced that our economy’s current and future competitiveness depends in large part on innovation and on the green, inclusive transition of Quebec’s businesses.

Our commitments for the coming year will make it possible to establish a solid foundation to assist Quebec’s SMEs and communities in their transition to sustainable economic development.

To support businesses further in this transition, CED will promote the adoption of practices that take responsible environmental, social and governance (ESG) criteria into account. In a market where consumers, workers, and prime contractors are increasingly sensitive to climate change and other issues of the day, this approach will enable SMEs to better position themselves to meet their expectations, while contributing to their communities’ well-being and economic development in our regions.

Our government will help SMEs finance their green shift and also seek out the expertise they need to complete this transition. And CED will be here to assist them.

By choosing to act today in favour of businesses and regions making the green transition, CED is actively helping Quebec and Canada reach their objectives to reduce greenhouse gas emissions by 2030, all while building a resilient, sustainable, competitive economy for tomorrow.

Pascale St-Onge

Minister of Sport and Minister responsible for the Economic Development Agency of Canada for Quebec Regions

From the Institutional Head

During the next fiscal year, through its programs and services and in collaboration with various economic stakeholders and partners, Canada Economic Development for Quebec Regions (CED) will continue to support businesses and regions so they can grow, innovate, invest in new markets, become more competitive, and help build a green economy.

We will work with our community partners to assist businesses and regions with their green transition. This transition will enable SMEs to better internalize environmental risks, adapt to new expectations and new market needs, and ensure their long-term competitiveness.

This approach will enable CED to prioritize strategic investments in clean technologies, organizations that integrate ecofriendly practices into their operations, including by focusing on responsible environmental, social and governance criteria, and the regional ecosystems guiding SMEs that take action.

We will continue to implement adapted programs and services that respond to the community’s needs and realities. In this way, CED is providing concrete assistance to Quebec’s businesses so they can better position themselves and seize opportunities in a more inclusive, sustainable, competitive economy, all while enhancing the quality of life of all.

Wonderful challenges are on the horizon. CED will be here to help Quebec’s SMEs and regions overcome them.

Happy reading!

Manon Brassard

Deputy Minister / President,

Canada Economic Development for Quebec Regions

Plans at a glance

While the Quebec economy returned to its pre-pandemic level of activity in 2021—both in terms of gross domestic product (GDP) and the labour market—it faced headwinds in 2022. Issues that were present before the pandemic returned to the forefront, such as the labour shortage, and the productivity of Quebec businesses, which remains lower than that of Canada, the U.S. and other G7 countries. New challenges also emerged in 2022, including the highest level of inflation in nearly 40 years and the ensuing significant monetary tightening; ongoing disruptions in global supply chains; and geopolitical tensions.

These factors are negatively affecting Quebec’s economic outlook for 2023–2024: pessimism is spreading, both among consumers who are worried about their declining purchasing power and among businesses that are hesitant to invest.

However, the current situation is atypical, with a labour market whose resilience is clouding the issue: unemployment remains low and there are still a lot of vacant positions, so the decline in employment could be limited. That said, insufficient investment, at a time when Quebec’s main challenges point to the need for a significant correction in this regard, will continue to dampen the economic outlook for Quebec’s economy and its businesses.

In addition, the impacts of climate change are placing a heavy economic burden on populations and institutions that are calling for action for a cleaner and healthier environment. Revenue losses in Canada due to the increased frequency and severity of weather events could cause a significant decline in GDP in the coming years—even decades—with northern, coastal and resource-dependent communities, including rural and remote communities and Indigenous communities, being especially vulnerable. As such, the mobilization of Quebec businesses, particularly SMEs, and the ecosystems that support them is essential since they are important partners in the fight against climate change and the environmental transition of the economy.

Accordingly, in 2023–2024, Canada Economic Development for Quebec Regions (CED) will continue to implement its programs in order to support the investments required to ensure the competitiveness, growth and vitality of small and medium-sized businesses (SMEs) and communities in all regions of Quebec. We will continue to be a key federal player in the province’s economic development by working in collaboration and complementarity with regional actors, and by delivering programs, services and expertise tailored to the realities of the various regions of Quebec so that they can participate in the transition to a more resilient, innovative, sustainable and inclusive economy.

We will have two main priorities in 2023–2024:

1. Support the post-pandemic recovery of SMEs and the regions

In order to continue the post-pandemic recovery of SMEs and regions, and to cope with inflation, supply chain challenges and labour scarcity, we will continue to support the competitiveness of businesses and vitality of communities through our regular programs. Furthermore, we will complete the five pan-Canadian economic recovery initiatives announced in the 2021 budget. Specifically, we will complete projects received under the Canada Community Revitalization Fund (CCRF); the Major Festivals and Events Support Initiative (MFESI) and the Tourism Relief Fund (TRF). We will also continue to implement the Jobs and Growth Fund (JGF) and the Aerospace Regional Recovery Initiative (ARRI).

2. Accelerate the green transition of SMEs and the regions

To help the Quebec economy make the transition to more sustainable business models and contribute to Canada’s ambitious climate change and environmental protection goals, we will implement our Action Plan announced on December 15, 2022, which aims to accelerate the green transition of SMEs and the ecosystems that support them.

In Quebec, SMEs know that they need to adapt their business practices but do not always have the resources or expertise to do so. By focusing on the green transition and innovation as levers for growth and competitiveness, we will further encourage SMEs to make this strategic shift, improve their productivity and thus ensure sustainable growth for all regions of Quebec.

Our commitments for 2023–2024 include raising our annual target for investments to support the green transition to $40M, and increasing this amount to $50M as of 2025–2026. These strategic investments will leverage greener technologies and practices, and contribute to the 2022–2026 Federal Sustainable Development Strategy (FSDS), the 2030 Emissions Reduction Plan: Clean Air, Strong Economy, and the creation of sustainable jobs.

Our new green transition web page provides more information on the concrete commitments we will be putting in place.

For more information on CED’s plans, see the “Core responsibility: planned results and resources, and key risks” section of this plan.

Core responsibilitiy: planned results and resources, and key risks

This section contains information on the department’s planned results and resources for its core responsibility. It also contains information on key risks related to achieving those results.

Developing Quebec’s economy

Description

Support economic growth and prosperity and job creation in Quebec by means of inclusive clean growth; help SMEs grow through trade and innovation; and build on competitive regional strengths.

Planning highlights

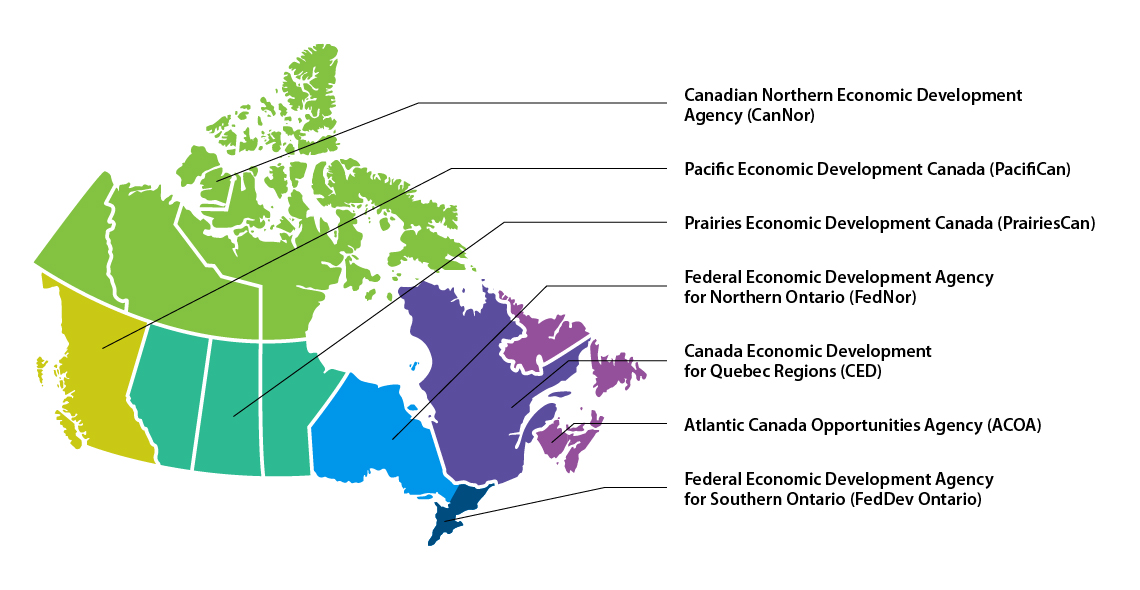

Text version of Regional representation

| Province/Territory | Regional development agency support |

|---|---|

| Alberta | Prairies Economic Development Canada (PrairiesCan) |

| British Columbia | Pacific Economic Development Canada (PacifiCan) |

| Manitoba | Prairies Economic Development Canada (PrairiesCan) |

| New Brunswick | Atlantic Canada Opportunities Agency (ACOA) |

| Newfoundland and Labrador | Atlantic Canada Opportunities Agency (ACOA) |

| Northwest Territories | Canadian Northern Economic Development Agency (CanNor) |

| Nova Scotia | Atlantic Canada Opportunities Agency (ACOA) |

| Nunavut | Canadian Northern Economic Development Agency (CanNor) |

| Ontario | Northern Ontario: Federal Economic Development Agency for Northern Ontario (FedNor) Southern Ontario: Federal Economic Development Agency for Southern Ontario (FedDev Ontario) |

| Prince Edward Island | Atlantic Canada Opportunities Agency (ACOA) |

| Quebec | Canada Economic Development for Quebec Regions (CED) |

| Saskatchewan | Prairies Economic Development Canada (PrairiesCan) |

| Yukon | Canadian Northern Economic Development Agency (CanNor) |

CED and the six other regional development agencies (RDAs) work together to contribute—within the confines of their respective mandates—to the economic development of the regions of Canada.

To achieve its core responsibility, CED seeks to contribute to, and influence, the three departmental results below. We will prioritize the economic recovery and the green transition in all regions of Quebec in order to support the achievement of our departmental results, which will nevertheless remain subject to the economic context.

The world is undergoing profound transformations in various fields, including technologies, demographics, supply chains and international trade, as well as the environment (climate change), which will call for significant investment on the part of businesses and communities, even though an economic slowdown, perhaps even a recession, is looming on the horizon.

Departmental result 1: Quebec businesses are innovative and growing

In 2023–2024, we will continue to stimulate innovation, productivity and growth of Quebec businesses in a post-pandemic context, both through our regular programs and through specific economic recovery initiatives.

- Aerospace Regional Recovery Initiative (ARRI):

Recognizing the major role of the aerospace industry in the value of Quebec's exports and the impacts of the pandemic on the sector, we will continue to receive applications for funding under this national program, launched in June 2021. Through ARRI, we will fund projects by businesses and the organizations that support them to adopt clean technologies and green their operations, while encouraging commercialization and export. A $89.7M grants and contributions (G&C) budget for fiscal years 2021–2022 to 2023–2024 is dedicated to ARRI for Quebec. - Jobs and Growth Fund (JGF):

Through the JGF, we will continue to fund projects that assist SMEs and the organizations that support them in the transition to a green economy and an inclusive recovery, while improving their competitiveness and creating jobs. We will promote resilient and long-term growth in an economic context characterized by the integration of new technologies (including digitization), persistent supply challenges, and adjustments in value chains. A $135.8M G&C budget of for fiscal years 2021–2022 to 2023–2024 is dedicated to the JGF for Quebec.

Besides specific efforts associated with temporary recovery initiatives, CED also delivers the national Regional Economic Growth through Innovation (REGI) program, which remains its main source of funding for innovative SMEs and the organizations that support them. Through the REGI program, we will continue to help businesses accelerate their digital transformation and robotize and automate their production activities, particularly in the manufacturing and high value-added services sectors. Our goal is to help companies grow and become more productive so that they can boost their competitiveness on international markets (in compliance with applicable international agreements), as well as to address the labour shortage that remains a major issue in many regions and economic sectors of Quebec. We will also pursue our support for innovative businesses through funding for business incubators and accelerators.

In keeping with our commitment to fight climate change, we will step up our efforts to accelerate the greening of SMEs. We will focus on the capacity of SMEs to improve their environmental performance, adopt less energy-intensive technologies and develop cleaner technologies and solutions. Furthermore, as set out in our new green transition plan, we will provide funding for the business support ecosystem to help develop or strengthen high-intensity assistance services in all regions of Quebec to ensure that businesses receive the support they need to contribute to the transition to a much more environmentally friendly economy.

Finally, we will continue to promote the capabilities of Quebec’s SMEs and research centres among major clients to allow them to take advantage of the opportunities generated by the Industrial and Technological Benefits (ITB) Policy. Given the anticipated increase in public investment in the defence sector, ITB represents a lever for growth, diversification and exports in Quebec’s economy.

Departmental result 2: Communities are economically diversified in Quebec

In 2023–2024, our support for communities will include the implementation of our post‑pandemic recovery priority, as noted in the previous section.

This includes completing the following one-time initiatives, as we continue to support our clients in completing their projects:

- Major Festivals and Events Support Initiative (MFESI):

Tourism is an anchor sector in the regions of Quebec that was severely affected by the pandemic. Through the MFESI, CED helps major festivals and events that generate over $10M in annual revenue address the impacts of the pandemic and position themselves for the future. Because these festivals and events attract local and foreign tourists, they are important economic levers in communities. CED’s funding will allow them to maintain, adapt and enhance their activities in a recovery context, and attract a growing and diversified clientele.

- Tourism Relief Fund (TRF)

Investments made through the TRF will help regional tourism businesses and organizations get back on track in terms of profitability, and will allow Quebec’s regional destinations to position themselves for future growth with new or improved experiences and products.

- Canada Community Revitalization Fund (CCRF)

Through the CCRF, CED is building on the recovery in rural communities and cities across Quebec by investing in facilities and infrastructure that contribute to community vitality, support social and economic cohesion, and help restart community economies. This national program contributes to job creation and fosters the return of people to public spaces.

Our regular programs

Local and regional businesses remain important to CED, as they have a significant impact in communities that are less economically diversified. To this end, the following regular programs will continue to support the development of local economies and promote the regions of Quebec:

- Quebec Economic Development Program (QEDP)

The QEDP channels its support to local business projects; the international marketing of tourist attractions to encourage increased spending by tourists from outside Quebec; and efforts to attract foreign investment. - Community Futures Program (CFP)

The CFP funds the operations of Community Futures Development Corporations (CFDCs) and Business Development Centres (BDCs), which provide funding and technical assistance for small businesses and support various local development initiatives. Through the CFP, we will continue to support SMEs and communities in rural Quebec.

Inclusive economy

Addressing social and economic disparities and inequities is a priority for the Government of Canada. The 2021 Speech from the Throne and subsequent mandate letters reiterated the Government’s intention to support inclusive economic growth and to continue its efforts towards reconciliation and the inclusion of Indigenous peoples in the Canadian economy.

Through our interventions, we will pursue our commitment to equity, diversity and inclusion (EDI) and our support for the economic development of Indigenous communities (First Nations, Inuit and Métis) in Quebec. In the fall of 2022, CED launched a new EDI approach applicable to all its programs and initiatives. This approach includes engaging our advisors who work with our clients, making additions to our funding application forms, and showcasing relevant information on our website to raise awareness about EDI opportunities and equip businesses and organizations with the necessary tools to be able to incorporate these principles into their business processes and practices.

In addition, we will continue to pay particular attention to the needs of Indigenous communities by adapting our interventions in the context of economic recovery initiatives, while implementing projects with an inclusive component to address barriers to the economic participation of these communities. Specifically, CED endorses the Nunangat Policy, which came into force in April 2022 and aims to ensure that Inuit-specific needs and circumstances are taken into account in federal measures and initiatives. We will implement this policy in 2023–2024 through our programs and initiatives. We will also continue to foster more inclusive economic growth by supporting entrepreneurs from various under-represented groups. The following initiatives will promote inclusive prosperity and equal opportunities for all:

- Launched in 2008 and implemented by the RDAs and ISED, the national Economic Development Initiative (EDI) – Official Languages supports the economic development of official language minority communities (OLMCs). CED will seek to strengthen its efforts to provide targeted support for Quebec’s English-speaking OLMCs, with a view to meeting their changing needs and unique circumstances, including the negative economic impacts these communities experienced during the COVID-19 pandemic.

- The Black Entrepreneurship Program (BEP) Ecosystem Fund, announced in September 2020 for a four-year period, will provide funding for organizations led by Black community members to support entrepreneurship, which has long faced inadequate funding.

Finally, as part of its mandate, CED will remain attentive to the vulnerabilities and needs of SMEs and communities, which differ from one region and sector to another.

Departmental result 3: Businesses invest in the development and commercialization of innovative technologies in Quebec

The REGI program will continue to bolster the growth of businesses by helping them improve their capacity to identify market opportunities, access potential clients, manage business relationships, break into national and international markets, integrate global value chains, and access public markets and ITB. REGI funding will specifically target the commercialization of products resulting from innovation with a view to developing or diversifying international markets, in compliance with applicable international agreements.

Furthermore, through its funding for Regional Quantum Innovation (RQI), CED will spend $23.3M over seven years (from 2021–2022 to 2027–2028) to help SMEs and non-profit organizations (NPOs) adopt, develop and commercialize quantum technologies, and products based on these technologies. Quantum technologies will transform key sectors of our economy, notably information technology (algorithms and quantum simulations, etc.); communications and cybersecurity (cryptography and encryption, etc.); sensing technology (sensors, atomic clocks, quantum compasses, etc.); imaging (medical and thermal imaging, etc.); and the development of innovative materials (microfabrication, materials with new quantum properties, etc.).

We will also contribute to the greening of the economy in the regions of Quebec by supporting projects involving the development and commercialization of new clean technologies and products in fields such as bioproducts, bioenergy and energy efficiency, and other measures linked to the green transition. In addition, an environmental characterization grid will be applied to all our programs as of April 1, 2023. This grid will allow us to document the extent to which our clients’ activities and projects make up part of a dynamic of transition towards a green economy.

Finally, CED supports dynamic economic innovation ecosystems to facilitate the emergence of new ideas and the development of business projects. We will therefore continue to fund business technology transfer organizations, notably in the clean tech sector, with a view to boosting the potential of regional innovation ecosystems. As such, CED could support certain college centres for technology transfer (CCTTs), which are affiliated with the Quebec college network. CCTTs contribute to the development and realization of technological and social innovation projects, as well as to the implementation and dissemination of innovation within businesses and organizations.

Gender-based analysis plus

In 2023–2024, CED will continue to strengthen its internal gender-based analysis plus (GBA Plus) and EDI practices and capacity. With a view to fostering an inclusive economic recovery and equitable access to our programs and services, we will continue to make GBA Plus an integral part of our policy and program development, design, implementation and evaluation.

We will also pursue our efforts to increase the economic participation of remote and rural communities and various groups that are under-represented in the Quebec economy: women, youth, persons with disabilities, Indigenous peoples, newcomers to Canada and immigrants, members of the 2ELGBTQI+ community, members of Black communities and other racialized groups, and members of Quebec’s English-speaking OLMCs.

Our annual departmental plan establishes objectives for five of these target groups, specifically in terms of the percentage of SMEs owned by women, youth, racialized groups, Indigenous peoples and persons with disabilities.

United Nations 2030 Agenda for Sustainable Development and the UN Sustainable Development Goals

To understand how CED’s activities, initiatives, policies and programs contribute to the UN Sustainable Development Goals, please refer to the 2030 Agenda for Sustainable Development and the United Nations Sustainable Development Goals supplementary table.

Innovation

In 2023–2024, we will continue to modernize our digital tools and our hybrid-work enabling environment by introducing a structured approach based on experimentation and iteration to support the operational performance of staff and fully deliver on our mandate for Canadians.

Key risk(s)

Risk 1: Information Technology (IT) security

The COVID-19 pandemic highlighted the dependence on and risks associated with technological infrastructure and data protection. Public organizations are a prime target and hackers are becoming increasingly creative in how they get their way.

With a view to mitigating these risks, we will continue deploying active cybersecurity measures. We will also implement a cybersecurity awareness and training strategy to equip and prepare staff to adopt the right reflexes when dealing with cybersecurity issues.

Risk 2: Workforce health and well-being and remote management

Since the beginning of the pandemic, staff have been challenged by a variety of factors that affect workload and the way we do business. For example, the record number of recovery initiatives being deployed since 2021–2022 is putting pressure on the workforce, which is being exacerbated by pandemic fatigue and labour shortages in many job categories across the organization. There is a risk that the health and well-being of the workforce will be affected, which could reduce their performance. There is also a risk that managers may not be fully skilled and equipped to effectively manage the workforce in the face of profound change, which could affect the effectiveness of the organization and the health and well-being of employees.

To address these issues, we will continue our efforts to deal with workload challenges and foster innovation and efficiency. We also plan to provide increased support to managers to meet the challenges of managing in a hybrid mode and to increase opportunities for staff communication and feedback. In addition, we will maintain the services of an Ombuds and a Mental Health and Wellness Committee. Finally, we will develop a new integrated human resources plan for the next three years and adjust our recruitment practices to address the labour shortage, continuing our ongoing efforts to attract and retain a skilled and diverse workforce.

Risk 3: Program delivery

The economic slowdown is likely to have a negative impact on Quebec businesses, particularly due to a decrease in order backlog and a reorganization of supply chains. In addition, labour scarcity and high inflation are putting additional pressure on companies' resources. This situation fuels the risk that companies, now more indebted, will cancel or delay their investment projects necessary to modernize their operations.

To help Quebec businesses in this new and changing economic context, we will ensure that we adapt the implementation of our regular programs to meet emerging needs according to regional realities. We will also continue to implement some of the economic recovery initiatives announced in the 2021 budget so that organizations and businesses can adapt their practices to facilitate their growth.

Planned results to Develop Quebec’s economy

The following table shows, to Develop Quebec’s economy, the planned results, the result indicators, the targets and the target dates for 2023–24, and the actual results for the three most recent fiscal years for which actual results are available.

| Departmental result | Departmental result indicator | Target | Date to achieve target | 2019–20 actual result |

2020–21 actual result |

2021–22 actual result |

|---|---|---|---|---|---|---|

| R1: Quebec businesses are innovative and growing | Number of high‑growth businesses in Quebec (by revenue) | 2,900 | March 31, 2024 | Not available (N/A) ** | 3,030 | 3,400 |

| Value of Quebec’s goods’ exports | $97,2B | March 31, 2024 | $88.6B | $82.6B | $97.2B | |

| Value of Quebec’s clean‑tech exports | $2,4B | March 31, 2024 | $2.5B | $2.5B | $2.4B | |

| Revenue growth rate of businesses supported by CED programs | 2.0% | March 31, 2024 | N/A** | N/A** | 4.4% | |

|

R2: Quebec communities are economically diversified |

Percentage of SMEs in Quebec that are majority‑owned by women, Indigenous peoples, youth, visible minorities or persons with disabilities |

Women: 16% Indigenous peoples: 1.1% Youth: 14.4% Visible minorities: 4.3% Persons with disabilities: 0.4% |

March 31, 2024 |

Women: N/A** Indigenous peoples: N/A** Youth: N/A** Visible minorities: N/A** Persons with disabilities: N/A** |

Women: N/A** Indigenous peoples: N/A** Youth: N/A** Visible minorities: N/A** Persons with disabilities: N/A** |

Women: 16.0% Indigenous peoples: 1.1% Youth: 14.4% Visible minorities: 4.3% Persons with disabilities: 0.4% |

|

Percentage of professional jobs in science and technology in the Quebec economy |

38.0% |

March 31, 2024 |

36.4% |

39.1% |

38.8% |

|

|

Amount leveraged per dollar invested by CED in community projects |

$2.20 |

March 31, 2024 |

$2.24 |

$1.80 |

$2.23 |

|

|

R3: Businesses invest in the development and commercialization of innovative technologies in Quebec |

Value of R&D spending by businesses receiving CED program funding |

$25M |

March 31, 2024 |

$62M |

$32M |

N/A* |

|

Percentage of businesses that collaborate with Quebec institutions of higher learning |

22% |

March 31, 2024 |

N/A** |

23.1% |

N/A** |

- *The targets established take into account both the results of recent years as well as the more difficult economic environment anticipated for 2023-2024. This explains their conservative level.

- **“Not available” means that no data was published by Statistics Canada for the fiscal year in question.

- ***The data in the table corresponds to the most recent results published by Statistics Canada. The figures for previous years are those available and can be updated in the current or future fiscal years.

The financial, human resources and performance information for CED’s program inventory is available on GC InfoBase.

Planned budgetary spending to Develop Quebec’s economy

The following table shows, to Develop Quebec’s economy, budgetary spending for 2023–24, as well as planned spending for that year and for each of the next two fiscal years.

| 2023–24 budgetary spending (as indicated in Main Estimates) |

2023–24 planned spending |

2024–25 planned spending |

2025–26 planned spending |

|---|---|---|---|

| 461,433,534 | 461,433,534 | 215,068,028 | 205,832,784 |

Financial, human resources and performance information for CED’s program inventory is available on GC InfoBase.

Planned human resources to Develop Quebec’s economy

The following table shows, in full‑time equivalents, the human resources the department will need to fulfill this core responsibility for 2023–24 and for each of the next two fiscal years.

| 2023–24 planned full-time equivalents |

2024–25 planned full-time equivalents |

2025–26 planned full-time equivalents |

|---|---|---|

| 205 | 175 | 175 |

Financial, human resources and performance information for CED’s program inventory is available on GC InfoBase.

Internal services: planned results

Description

Internal services are the services that are provided within a department so that it can meet its corporate obligations and deliver its programs. There are 10 categories of internal services:

- management and oversight services

- communications services

- legal services

- human resources management services

- financial management services

- information management services

- information technology services

- real property management services

- materiel management services

- acquisition management services

Planning highlights

The 2023–2024 fiscal year will mark the third year of the Imagining 2024 initiative, an internal management framework aimed at achieving concrete organizational results based on three pillars: an engaged team in a healthy and modern environment; a recognized contribution; and responsive services. This will enable us to fulfill our mission more effectively, while focusing on the modernization of our processes and tools, as well as on innovation and continuous improvement in our ways of doing business.

A number of activities in line with Imagining 2024 will be continued in 2023–2024:

- We will implement various activities to foster staff engagement in a hybrid work environment and optimize the benefits thereof, and we will make a continuous effort to adapt to a changing reality and meet our strategic imperatives. We will provide targeted learning opportunities for managers. Workplaces will also be adapted to enable hybrid work.

- Our different digital dexterity tools available on the intranet will help us meet current and future staff training needs. By providing access to educational tutorials and problem-solving clips, the tool facilitates the digital empowerment of staff to help them meet the challenges of societal transformation, including those imposed by the emergence of telework and new technologies.

- We will continue to develop and maintain the new skills required to optimize the use of the new digital tools available. This year will also mark the rollout of the external client portal, thus modernizing the customer experience.

Planning for Contracts Awarded to Indigenous Businesses

CED supports the Government of Canada’s commitment to allocate at least 5% of the total value of contracts to Indigenous businesses every year. CED is part of Phase 2 of the Procurement Strategy for Indigenous Business (PSIB). In this regard, we have opted for a phased implementation of our procurement strategies with a view to meeting our obligations.

Methodology:

- Organize in-house awareness sessions on the obligation to use Indigenous businesses wherever possible for our goods and services procurement needs, and the importance of doing so.

- Add a PSIB section to our strategic procurement plan, including the following actions to ensure the achievement of our objective:

- Systematically determine at the beginning of the process the capacity of the Indigenous market to meet this need.

- Use the Indigenous Business Directory to find qualified suppliers in various sectors.

- Use mandatory standing offers / supply arrangements (SO/SA), including PSIB clauses for the acquisition of goods.

- Use set-aside methods (mandatory, voluntary and conditional set-asides).

- Target and invite Indigenous businesses in open solicitations.

- Further to the creation of a training curriculum specifically designed for technical authorities, we strongly encourage that the Indigenous Considerations in Procurement course be taken to gain a better understanding of the strategy.

Planning assumptions

These forecasts are based on average annual procurement spending of $3.2M, with a PSIB expenditure rate of 3% for 2022–2023 and a minimum of 5% for subsequent years.

- 2022–2023: $96,000 (3% of procurement budget)

- 2023–2024: $160,000 (5% of procurement budget)

- 2024–2025: $160,000 (5% of procurement budget)

| 5% reporting field description | 2021-22 actual % achieved | 2022-23 forecasted % target | 2023-24 planned % target |

|---|---|---|---|

| N.A. | N.A. | Phase 1: N.A. Phase 2: 3%: $96,000 |

5%: $160,000 |

Planned budgetary spending for internal services

The following table shows, for internal services, budgetary spending for 2023–24, as well as planned spending for that year and for each of the next two fiscal years.

| 2023–24 budgetary spending (as indicated in Main Estimates) | 2023–24 planned spending | 2024–25 planned spending | 2025–26 planned spending |

|---|---|---|---|

| 23,236,106 | 23,236,106 | 20,116,835 | 20,081,511 |

Planned human resources for internal services

The following table shows, in full‑time equivalents, the human resources the department will need to carry out its internal services for 2023–24 and for each of the next two fiscal years.

| 2023–24 planned full-time equivalents | 2024–25 planned full-time equivalents | 2025–26 planned full-time equivalents |

|---|---|---|

| 178 | 152 | 152 |

Planned spending and human resources

This section provides an overview of the department’s planned spending and human resources for the next three fiscal years and compares planned spending for 2023–24 with actual spending for the current year and the previous year.

Planned spending

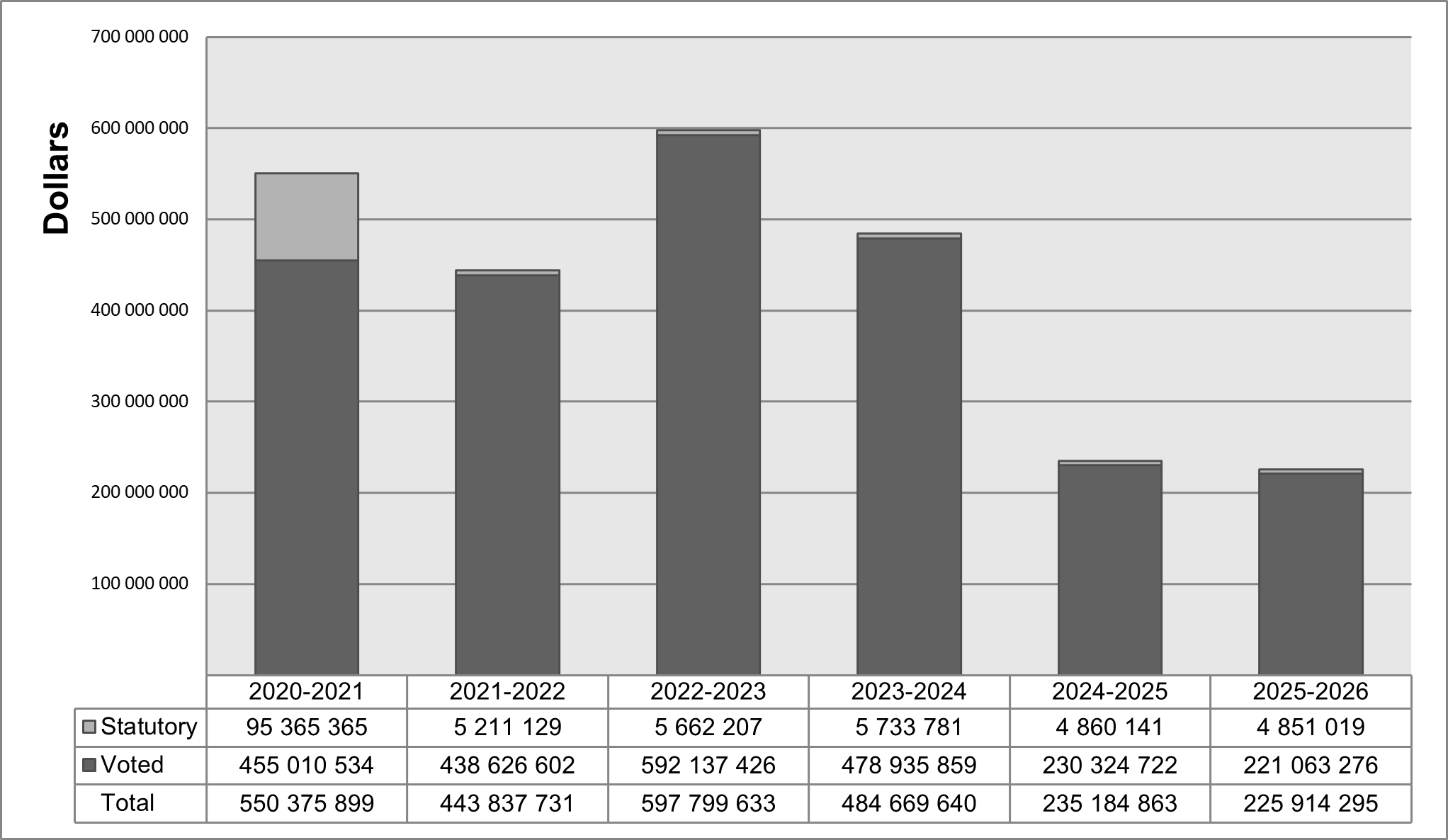

The following graph presents planned spending (voted and statutory expenditures) over time.

Text description of Departmental spending trend graph

From 2020–21 to 2025–26, planned statutory spending reached:

- $95,365,365 in 2020–21

- $5,211,129 in 2021–22

- $5,662,207 in 2022–23

- $5,733,781 in 2023–24

- $4,860,141 in 2024–25

- $4,851,019 in 2025–26

From 2020–21 to 2025–26, planned voted spending reached:

- $455,010,534 in 2020–21

- $438,626,602 in 2021–22

- $592,137,426 in 2022–23

- $478,935,859 in 2023–24

- $230,324,722 in 2024–25

- $221,063,276 in 2025–26

From 2020–21 to 2025–26, total planned spending reached:

- $550,375,899 in 2020–21

- $443,837,731 in 2021–22

- $597,799,633 in 2022–23

- $484,669,640 in 2023–24

- $235,184,863 in 2024–25

- $225,914,295 in 2025–26

CED expenditures vary over time, primarily based on the temporary and targeted funding we receive. In 2020–2021, expenditures reached $550.4M, including a large increase in legislative expenditures (representing $95.4M). This increase in spending was primarily due to new funding received in response to the economic crisis created by COVID-19. Exceptionally, CED used a temporary legislative appropriation to administer the Regional Relief and Recovery Fund (RRRF), due to the urgency of the situation.

The decrease in spending in 2021–2022 is due to reduced funding for one-time, targeted initiatives related to COVID-19, including the RRRF. Also, due to unique economic conditions - including labor shortages, price, and supply difficulties for many materials - many projects were slowed down, postponing planned expenditures into 2022–2023.

Projected expenditures in 2022–2023 will peak at $597.8M. This increase is primarily due to funding for new economic recovery initiatives launched in 2021–2022 to support the economy, details of which are provided in the next section. G&C carryover funds from unused budgets in 2021–2022 also contribute to the increase in projected expenditures in 2022–2023.

Conversely, the repayment moratorium granted to our clients in 2021–2022 to help them overcome the cash shortage caused by the crisis causes a shortfall in G&C budgets. Indeed, these refunds will be reinvested in the budgets two years after they are collected. They will therefore be recovered over a longer period than initially planned. Note that this decrease is not visible in the chart, as it is offset by the recovery initiatives and carryover funds.

Finally, the decrease in planned spending from 2023–2024 onwards is due in part to the anticipated end of funding for certain recovery initiatives, as described in the next section.

It should also be noted that planned spending in 2024–2025 and 2025–2026 does not include the reinvestment of revenues from repayable contributions from our clients, as the approvals had not been obtained at the time of writing.

Budgetary planning summary for core responsibilities and internal services (dollars)

The following table shows information on spending for each of CED’s core responsibilities and for its internal services for 2023–24 and other relevant fiscal years.

| Core responsibilities and internal services | 2020–21 actual expenditures |

2021–22 actual expenditures |

2022–23 forecast spending |

2023–24 budgetary spending (as indicated in Main Estimates) |

2023–24 planned spending |

2024–25 planned spending |

2025–26 planned spending |

|---|---|---|---|---|---|---|---|

| Develop Quebec’s economy | 527,799,525 | 419,042,755 | 574,684,684 | 461,433,534 | 461,433,534 | 215,068,028 | 205,832,784 |

| Internal services | 22,576,374 | 24,794,976 | 23,114,949 | 23,236,106 | 23,236,106 | 20,116,835 | 20,081,511 |

| Total | 550,375,899 | 443,837,731 | 597,799,633 | 484,669,640 | 484,669,640 | 235,184,863 | 225,914,295 |

CED's budget is generally composed of recurrent funding, used to deliver regular programs, and temporary funding, used to deliver one-time, targeted initiatives. The recurrent budget remains relatively stable over the years, while the temporary budgets vary according to economic conditions and events that have a significant impact on businesses or communities, such as the Lac-Mégantic train accident.

Projected expenditures in 2022–2023 will reach a record peak of $597.8M as funding for economic recovery initiatives will be at its highest level since the beginning of the pandemic.

A decrease in spending of $113M is projected in 2023–2024 due to the decrease in funding available for economic recovery initiatives, including the Tourism Relief Fund (TRF) and Canada Community Revitalization Fund (CCRF), and the end of funding for the Regional Air Transportation Initiative (RATI).

In 2023–2024, the projected G&C funding for recovery initiatives is as follows:

- $57.9M for the Jobs and Growth Fund:

- $43.9M for the Aerospace Regional Recovery Initiative

- $30.5M for the Canadian Community Revitalization Fund

- $26.1M for the Major Festivals and Events Support Initiative

- $22.5M for the Tourism Relief Fund

These initiatives end in 2023–2024, which explains the significant decrease in available funding in 2024–2025 and 2025–2026.

Planned human resources

The following table shows information on human resources, in full-time equivalents (FTEs), for each of CED’s core responsibility and for its internal services for 2023–24 and the other relevant years.

Human resources planning summary for core responsibilities and internal services

| Core responsibilities and internal services | 2020–21 actual full‑time equivalents |

2021–22 actual full‑time equivalents |

2022–23 forecast full‑time equivalents |

2023–24 planned full‑time equivalents |

2024–25 planned full‑time equivalents |

2025–26 planned full‑time equivalents |

|---|---|---|---|---|---|---|

| Develop Quebec’s economy | 189 | 213 | 215 | 205 | 175 | 175 |

| Internal services | 170 | 180 | 169 | 178 | 152 | 152 |

| Total | 359 | 393 | 384 | 383 | 327 | 327 |

In 2020–2021, CED received additional funding to help Quebec businesses, regions and communities overcome the economic difficulties created by the COVID-19 crisis. These initiatives continued in 2021–2022 and also, in the 2021 Budget, recovery initiatives were announced and took effect in 2021–2022. In order to deliver all of these initiatives and programs, the number of resources was increased for both internal services and for the core responsibility to Develop Quebec's Economy. For the year 2023–2024, a reallocation of funds from grants and contributions to the operating budget was made in order to stabilize the workforce and ensure the follow-ups and other activities essential to close the many recovery initiatives. Thereafter, the sharp decline in FTEs beginning in 2024–2025 is due to the end of the recovery initiatives.

Estimates by vote

Information on CED’s organizational appropriations is available in the 2023–24 Main Estimates.

Future-oriented condensed statement of operations

The future‑oriented condensed statement of operations provides an overview of CED’s operations for 2022–23 to 2023–24.

The forecast and planned amounts in this statement of operations were prepared on an accrual basis. The forecast and planned amounts presented in other sections of the Departmental Plan were prepared on an expenditure basis. Amounts may therefore differ.

A more detailed future‑oriented statement of operations and associated notes, including a reconciliation of the net cost of operations with the requested authorities, are available on CED’s website.

Future‑oriented condensed statement of operations for the year ending March 31, 2024 (dollars)

| Financial information | 2022–23 forecast results |

2023–24 planned results |

Difference (2023–24 planned results minus 2022–23 forecast results) |

|---|---|---|---|

| Total expenses1 | 472,031,000 | 318,618,000 | (153,413,000) |

| Total revenues | 0 | 0 | 0 |

| Net cost of operations before government funding and transfers | 472,031,000 | 318,618,000 | (153,413,000) |

1Expenditures are the economic resources used by CED during a period to deliver its programs. They are of two types: transfer payments and operations. Expenditures calculated in the Future-oriented Statement of Operations differ from the expenditures presented in the rest of the Departmental Plan, since unconditionally repayable contributions are accounted for as loans, thus reducing total transfer payment expenditures.

In 2023–2024, CED's total net expenditures are expected to be $318.6M. This is a decrease of 32.5% from the previous fiscal year. This decrease in planned spending is primarily due to the completion of one-time initiatives.

CED's planned spending consists of transfer payments––that is, expenses related to non-repayable and conditionally repayable contributions––and salaries and non-salaries (purchase of goods and services, travel, training, etc.). Expenses related to non-repayable and conditionally repayable contributions represent the majority of our expenses and are expected to total $265.3M in 2023–2024, a decrease of 36.2% from 2022–2023.

Our revenues, returned to the Treasury, are reported in our financial statements as earned on behalf of the government.

Corporate information

Organizational profile

Appropriate minister: The Honourable Pascale St-Onge

Institutional head: Manon Brassard

Ministerial portfolio: NA

Enabling instrument: Economic Development Agency of Canada for the Regions of Quebec Act

Year of incorporation / commencement: 2005

Raison d’être, mandate and role: who we are and what we do

Information on CED’s raison d’être, mandate and role is available on the Agency’s website.

Information on CED’s mandate letter commitments is available in the Minister’s mandate letter.

Operating context

Information on the operating context is available on CED’s website.

Reporting framework

| Departmental results framework | Core Responsibility: Economic Development in Quebec | ||

|---|---|---|---|

| Departmental Result: Businesses are innovative and growing in Quebec | Indicator: Number of high growth firms in Quebec | Internal Services | |

| Indicator: Value of exports of good (in dollars) from Quebec | |||

| Indicator: Value of exports of clean technologies (in dollars) from Quebec | |||

| Indicator: Revenue growth rate of firms supported by CED programs | |||

| Departmental Result: Communities are economically diversified in Quebec | Indicator: Percentage of SMEs that are majority-owned by women, Indigenous people, youth, visible minorities and persons with disabilities in Quebec | ||

| Indicator: Percentage of professional, science and technology-related jobs in Quebec’s economy | |||

| Indicator: Amount leverage per dollar invested by CED in community projects | |||

| Departmental Result: Businesses invest in the development and commercialization of innovative technologies in Quebec | Indicator: Value of Business Expenditure in Research and Development (BERD) by firms receiving CED program funding (in dollars) | ||

| Indicator: Percentage of companies engaged in collaborations with higher education institutions in Quebec | |||

| Program Inventory | Program: Regional Innovation | ||

| Program: Community economic development and diversification | |||

| Program: Targeted transition support | |||

Supporting information on the program inventory

Supporting information on planned expenditures, human resources, and results related to CED’s program inventory is available on GC InfoBase.

Supplementary information tables

The following supplementary information tables are available on CED’s website:

- Details on transfer payment programs

- Gender-based analysis plus

- United Nations 2030 Agenda for Sustainable Development and the Sustainable Development Goals

Federal tax expenditures

CED’s Departmental Plan does not include information on tax expenditures.

Tax expenditures are the responsibility of the Minister of Finance. The Department of Finance Canada publishes cost estimates and projections for government‑wide tax expenditures each year in the Report on Federal Tax Expenditures. This report provides detailed information on tax expenditures, including objectives, historical background and references to related federal spending programs, as well as evaluations, research papers and gender-based analysis plus.

Organizational contact information

Mailing address:

Canada Economic Development for Quebec Regions

800 René-Lévesque West BLVD., Suite 500

Montréal (Québec)H3B 1X9

Telephone: 514-283-6412

Fax: 514-283-3302

Website(s): ced.canada.ca

Appendix: definitions

- appropriation (crédit)

Any authority of Parliament to pay money out of the Consolidated Revenue Fund. - budgetary expenditures (dépenses budgétaires)

Operating and capital expenditures; transfer payments to other levels of government, organizations or individuals; and payments to Crown corporations. - core responsibility (responsabilité essentielle)

An enduring function or role performed by a department. The intentions of the department with respect to a core responsibility are reflected in one or more related departmental results that the department seeks to contribute to or influence. - Departmental Plan (plan ministériel)

A document that sets out a department’s priorities, programs, expected results and associated resource requirements, covering a three‑year period beginning with the year indicated in the title of the report. Departmental Plans are tabled in Parliament each spring. - departmental result (résultat ministériel)

A change that a department seeks to influence. A departmental result is often outside departments’ immediate control, but it should be influenced by program-level outcomes. - departmental result indicator (indicateur de résultat ministériel)

A factor or variable that provides a valid and reliable means to measure or describe progress on a departmental result. - departmental results framework (cadre ministériel des résultats)

A framework that consists of the department’s core responsibilities, departmental results and departmental result indicators. - Departmental Results Report (rapport sur les résultats ministériels)

A report on a department’s actual performance in a fiscal year against its plans, priorities and expected results set out in its Departmental Plan for that year. Departmental Results Reports are usually tabled in Parliament each fall. - full‑time equivalent (équivalent temps plein)

A measure of the extent to which an employee represents a full person‑year charge against a departmental budget. Full‑time equivalents are calculated as a ratio of assigned hours of work to scheduled hours of work. Scheduled hours of work are set out in collective agreements. - gender-based analysis plus (GBA Plus) (analyse comparative entre les sexes plus [ACS Plus])

An analytical tool used to support the development of responsive and inclusive policies, programs and other initiatives. GBA Plus is a process for understanding who is impacted by the issue or opportunity being addressed by the initiative; identifying how the initiative could be tailored to meet diverse needs of the people most impacted; and anticipating and mitigating any barriers to accessing or benefitting from the initiative. GBA Plus is an intersectional analysis that goes beyond biological (sex) and socio-cultural (gender) differences to consider other factors, such as age, disability, education, ethnicity, economic status, geography, language, race, religion, and sexual orientation. - government-wide priorities (priorités pangouvernementales)

For the purpose of the 2023–24 Departmental Plan, government-wide priorities are the high-level themes outlining the Government’s agenda in the 2021 Speech from the Throne: building a healthier today and tomorrow; growing a more resilient economy; bolder climate action; fighter harder for safer communities; standing up for diversity and inclusion; moving faster on the path to reconciliation and fighting for a secure, just, and equitable world. - high impact innovation (innovation à impact élevé)

High impact innovation varies per organizational context. In some cases, it could mean trying something significantly new or different from the status quo. In other cases, it might mean making incremental improvements that relate to a high-spending area or addressing problems faced by a significant number of Canadians or public servants. - horizontal initiative (initiative horizontale)

An initiative in which two or more federal organizations are given funding to pursue a shared outcome, often linked to a government priority. - non‑budgetary expenditures (dépenses non budgétaires)

Net outlays and receipts related to loans, investments and advances, which change the composition of the financial assets of the Government of Canada. - performance (rendement)

What an organization did with its resources to achieve its results, how well those results compare to what the organization intended to achieve, and how well lessons learned have been identified. - plan (plan)

The articulation of strategic choices, which provides information on how an organization intends to achieve its priorities and associated results. Generally, a plan will explain the logic behind the strategies chosen and tend to focus on actions that lead up to the expected result. - planned spending (dépenses prévues)

For Departmental Plans and Departmental Results Reports, planned spending refers to those amounts presented in the Main Estimates.

A department is expected to be aware of the authorities that it has sought and received. The determination of planned spending is a departmental responsibility, and departments must be able to defend the expenditure and accrual numbers presented in their Departmental Plans and Departmental Results Reports. - program (programme)

Individual or groups of services, activities or combinations thereof that are managed together within a department and that focus on a specific set of outputs, outcomes or service levels. - program inventory (répertoire des programmes)

An inventory of a department’s programs that describes how resources are organized to carry out the department’s core responsibilities and achieve its planned results. - result (résultat)

An external consequence attributed, in part, to an organization, policy, program or initiative. Results are not within the control of a single organization, policy, program or initiative; instead, they are within the area of the organization’s influence. - statutory expenditures (dépenses législatives)

Expenditures that Parliament has approved through legislation other than appropriation acts. The legislation sets out the purpose of the expenditures and the terms and conditions under which they may be made. - target (cible)

A measurable performance or success level that an organization, program or initiative plans to achieve within a specified time period. Targets can be either quantitative or qualitative. - voted expenditures (dépenses votées)

Expenditures that Parliament approves annually through an Appropriation Act. The vote wording becomes the governing conditions under which these expenditures may be made.